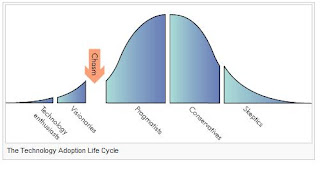

They say that technology happens in waves. They being Gartner and the like.

You get early adopters, then rapid growth in popularity, a peak of excitment then a long decline. Drawn on a digram, representing, say, adoption, it's like a big wave.

Well, the OBIEE wave formed and a whole bunch of consulting firms have got there surfboards out. But has the wave already crashed onto the beach?

I tend to use the job market as an indicator of the projects and skills in demand.

Five years ago when we started our Analytics consultancy, there were 1-2 new jobs per week advertised for Siebel Analytics consultants (pre-runner to OBIEE). That grew over the next couple of years to approx 6 real jobs per day. Although there would be 20 adverts, lots were agencies fishing for CV's, others were two agencies with the same job. We knew most of the projects in the UK, as there were not that many. As the market grew so did our business, life was very busy.

The reason for our success was getting trained people onboard. This cost a fortune, as Siebel controlled the training closely, charged high prices, and refused to allow others to publish training material.

Then along came Oracle and bought Siebel, renaming the product and heavily marketing OBI (EE and others).

At first this killed the market off. Uncertainty over Oracle intentions, and re-organisations in the salesforce meant that new sales were low and new projects went to other products.

Momentum was returned to the Oracle Business Intelligence set of products and the wave got going again. Six months ago there were dozens of jobs on the internet and companies were snapping up OBIEE.

I also look at the competition in the marketplace. When we started the business there were two companies in the UK who offered Siebel Analytics consulting, us and Innoveer. Slowly this increased, but mainly in mainland Europe. The UK market was too small and specialised for major investment. Customer Systems, Rossett Stone, Abbusys, ClearPeaks, and a bunch of offshore other companies set about the our market. These were good small companies, run by hard working specialist who know the Siebel product well and added the Analytics skills. I know all these people having worked, with, for and in competition with, on dozens of projects. These people invested a great deal in the hope of a growing market - they joined the curve on the way up!

When Oracle finally got it's act together they completly opened the market up. Publishing deals were allowed, other companies could run training (Including us), the software was made freely available for development, marketing activity went through the roof -the last UKOUG Business Intelligence conference was wall to wall Oracle presentations (I hope we get some variety tomorrow).

This led to an enormous influx of consultancies suddenly interested in the OBI product set. Competition became fierce, but we kept winnning work based upon REAL experience, and due to the fact we stick to what we know, OBIEE and Siebel Analytics Applications. Rates droppped and every independent consultant was putting Oracle BI on their CV. Desperate for experience they were killing the normal rates for contractors and undermning the credibility of the product.

(There are still dozens of high profile firms out there pretending to be experts in OBIEE - ask them how many real projects they have done)

Then along came a market confidence knock.

Due to a credit crunch, fuel prices, or whatever, the floor dropped out of the market. Search today on Jobserve for OBIEE jobs and ONE comes back. It pays really bad and has been open for months, and is in Edinburgh (not too bad in the summer). Search for Siebel Analytics and you get 2 jobs, in Switzerland and France.

I have a good network with the other independent experienced Analytics consultants based in the UK. They are manily working overseas in Europe (thankfully a good Euro-GBP rate at the moment). I know of several individuals that are looking, and will be available soon. Is there an over supply of Analytics /OBIEE experts?

There are a couple of roles that have not been advertised recently but one is not paying enough for a an expert with the level of experience they need, and the other will probably be filled by the available consultants on the market without the need to advertise.

So, has the wave crashed on the beach??

One theory is that projects are on hold or cancelled.

One factor may be reduced Oracle sales (have to wait and see on that one).

I think a huge factor is the type of customer that would normally implement OBIEE. They're big, normally very big. OBI can be expensive to buy (unless you go for the cheaper packages) and be expensive to implement. Maybe the budgets are tight this year, but these companies normally have large outsourcing deals with the major IT/Consulting firms - IBM, Accenture, CSC, TCS, HP, CapGemini, Deloitte, etc, and most of these firms are begining to compete on price - get the work offshore and charge peanuts. Until now the skills have been in short supply. I have worked for every one of the above, filling a gap in their knowledge. But now they have set-up their Indian operations and the skills are getting there (not as good as ours abviously!). My last project manager at CSC has been sent to India to manage the operation.

So my conclusion is that the number of projects are down, the number of consultants available are up, and the offshore model is beginning to bite.

Time to stop surfing and get the Kite board out!!

2 comments:

Has the market gotten that bad over there in the UK and EU?

Is the market as bad over in the US?

Hi Jack

It's not that bad, just not booming anymore. The daily news is always doom and gloom, but with house prices falling, interest rates about to rise, the strength of the euro, and unemployment rising, one can always look to the negative.

I see that a couple of jobs were posted today, and the BI conference had a good turnout. So some positives to be found :)

Post a Comment